Dear Members,

As you would recall Members were informed at the Annual General Meeting held on the 22nd day of March, 2019 that Genesis Insurance Brokers and Benefits Consultants Ltd was appointed on March 7, 2019 to review the existing TTD Health Plan arrangements and to conduct a market review to provide an alternative solution for consideration.

The appointment of Genesis Insurance Brokers and Benefits Consultants Ltd. arose in circumstances in which the renewal terms discussed by TATIL at a meeting on the 28th February, 2019 were considered untenable by the Insurance Committee.

Having been appointed as our Brokers in relation to the TTD Health Plan Genesis Insurance Brokers and Benefits Consultants Ltd. proceeded to negotiate directly with TATIL on behalf of the LATT and to procure quotations from multiple insurers in an effort to ensure continuity of coverage for our Members.

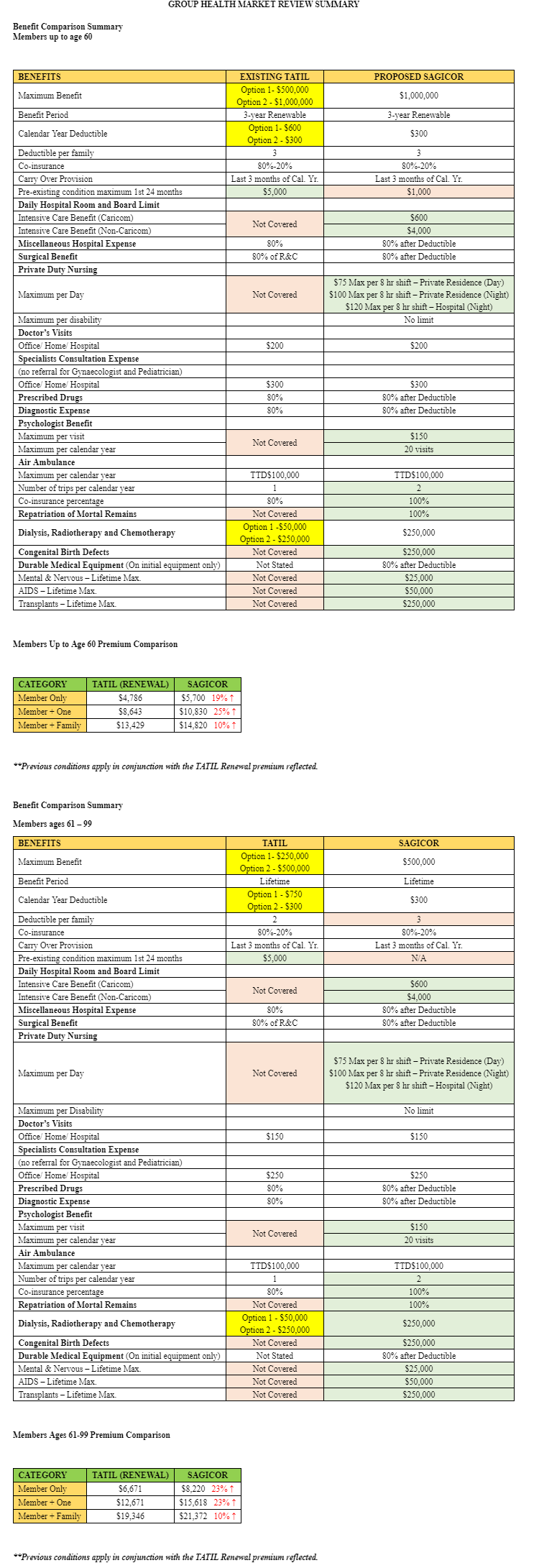

The following renewal options were offered by the incumbent TATIL to Genesis Insurance Brokers and Benefits Consultants Ltd:

TATIL’s Renewal Options

Option 1

- A reduction in the Maximum Benefit by 50%

- Up to age 60 from $1M to $500K

- Age 61 to 65 -$500K to $250K

- Dialysis, Radiotherapy and Chemotherapy reduced from $250,000 to $50,000 (combined)

- Increase in deductible from $300 to $600 (Members up to age 60) and $300 to $750 (Members ages 60-75)

- TATIL also proposed that LATT pay the difference on account of any loss of premium in the event that at least 165 members did not renew in 2019

Option 2

- Keep the existing Benefits and Premium as exist

- Any claims over the 75% of the Net premiums will be paid by Tatil but reimbursed (on a monthly basis) by LATT

Genesis Insurance Brokers and Benefits Consultants Ltd. then invited quotations from several other insurers. The quotation secured from Sagicor was considered to be the most viable option and tables setting out comparisons of the TATIL and Sagicor options are included in this email:

BENEFIT ENHANCEMENTS NEGOTIATED WITH SAGICOR’S PLAN

The following benefits were not covered under the TATIL plan which will now be covered under the Sagicor Plan:

- Private duty nursing

- Intensive care benefit

- Psychologist benefit

- Repatriation of Mortal Remains

- Congenital Birth Defects

- Mental & Nervous

- AIDS

- Transplants

- Sagicor’s plan is inclusive of a robust Medical Provider Network

- CariCare [swipe] Card pays Providers directly by the Insurer

- MediCard discounts are available at more than 400 Providers including health providers, groceries, restaurants, etc

- No Waiting Period for Maternity

- ** Please note that plan members will be covered up to age 99 once enrolled on the Plan.

CONDITIONS WITH SAGICOR’S OPTION

An open enrolment period effective April 1, 2019 to May 31, 2019 has been negotiated for both transfer and new members:

Transferred Members

- As a transferred group, ALL pre-existing conditions are accepted and the waiting period for the dental and vision will NOT be applicable

- Transfer Members must enrol in the Group Health Plan within the open enrolment period to be exempt of medical underwriting.

- Only requirement to enrol is: completion of the Sagicor Enrolment form and pay the required premium.

New Entrants ONLY

- New Entrants up to age 60 who enrol in the Group Health Plan within the open enrolment period will be exempt from medical underwriting. Only requirement to enrol is: completion of the Sagicor Enrolment form and pay the required premium.

Please note for ALL New Entrants up to age 60 there is a pre-existing condition maximum of $1,000 for the first 24 months, as well as waiting periods for Dental and Vision.

- New Entrants between the ages of 61 to 64 will be required to complete the enrolment and Group Health Statement (GHS) form and pay the required premium. However if further medical information is required, Sagicor will advise accordingly. This will be done at member’s expense.

- New Entrants between the ages of 65 to 99 will be required to complete the Enrolment form and pay the required premium. Once this is submitted to Sagicor, a Medical Request Form will then be provided to complete a full medical and micro analysis. This will be done at member’s expense.

The payment options have now been revised and includes an ACH payment option.

The Brokers have recommended that Law Association of Trinidad and Tobago switch the existing Group Health TTD coverage to Sagicor.

The revised /relevant documents, forms and contact information in order to transition to or enrol in the Sagicor TTD Group Health Plan may be accessed at the link below:

Members are asked to contact the Brokers directly to arrange for coverage. The contact information for Genesis Insurance Brokers and Benefits Consultants Ltd. is contained in the Sagicor Enrolment Payment Process and Claims Submission Form which may be accessed at the link above.

Kind regards,

LAW ASSOCIATION OF TRINIDAD & TOBAGO